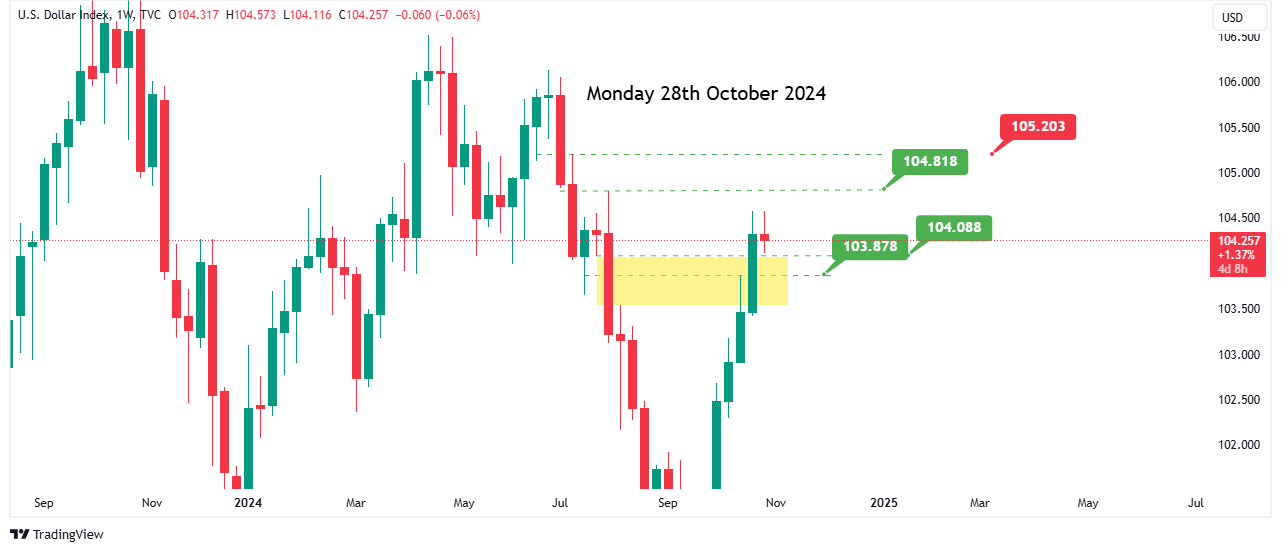

A Bullish Week for the Dollar (28th/10/2024)

Michelle Mwende

Oct. 28, 2024, 6:48 p.m.

It is yet another bullish week for the dollar, following last week’s massive rally upwards as shown in the image. Starting this week we expect a little pull back to level 104.088 before the rally upward resumes. We might see the dollar dip a bit lower to level 103.878 before it continues going up. If the dollar continues delivering higher, we might see it reaching for level 104.018 this week. The next price level that we might see the price reaching for if it continues on this rally is level 105.203. With the US elections happening next week, we expect to see a very volatile price action. In very volatile conditions, the best setups are those that are in alignment with the overall price conditions, which in our case is the bullish bias this week. In simple terms, it will be best to look for buy setups this week than trading against the overall trend. We expect to see very large candle wicks this week, and as a precaution we advice that you take your profits at the nearest point of liquidity. It will also be beneficial to trade the simplest and most obvious price action due to the prevailing market conditions. You can use the Elite’s trading pattern this week as it is quite simple and straightforward, and you can get it here "Elites Trading Bible." Have an awesome trading week.

This post contains affiliate links. I may earn a small commission fee if you make a purchase through the links. Thanks.

Disclaimer

The publisher and author make no representations or warranties with respect to the accuracy or completeness of these contents and disclaim all warranties such as warranties of fitness for a particular purpose. The author or publisher is not liable for any damages whatsoever. The fact that an individual or organization is referred to in this document/website as a citation source of information does not imply that the author or publisher endorses the information that the individual or organization provided. The information provided here is of the nature of a general comment only and neither purports nor intends to be, specific trading advice. It has been prepared without regard to any particular person’s investment objectives, financial situation and particular needs. The information should not be considered as an offer or enticement to buy, sell or trade.

Profits in trading come from discipline and strategy, not from chasing the market.

winfred

Oct. 29, 2024, 1:59 p.m.

Very helpful insights