The Only Forex Trading Strategy You Need to Know

Michelle Mwende

Oct. 7, 2025, 3:34 p.m.

The Smart Money Forex Trading Strategy You Need to Know

If you’ve been jumping from one trading strategy to another, hoping to find the perfect setup that actually works — stop. This lesson will simplify everything. At Elite Inner Traders, we believe that mastering one high-probability setup is far more powerful than knowing ten half-understood ones.

Today, we’ll break down the only Forex trading strategy you need to know, built around multi-timeframe confluence, market structure shifts, and smart money concepts (SMC).

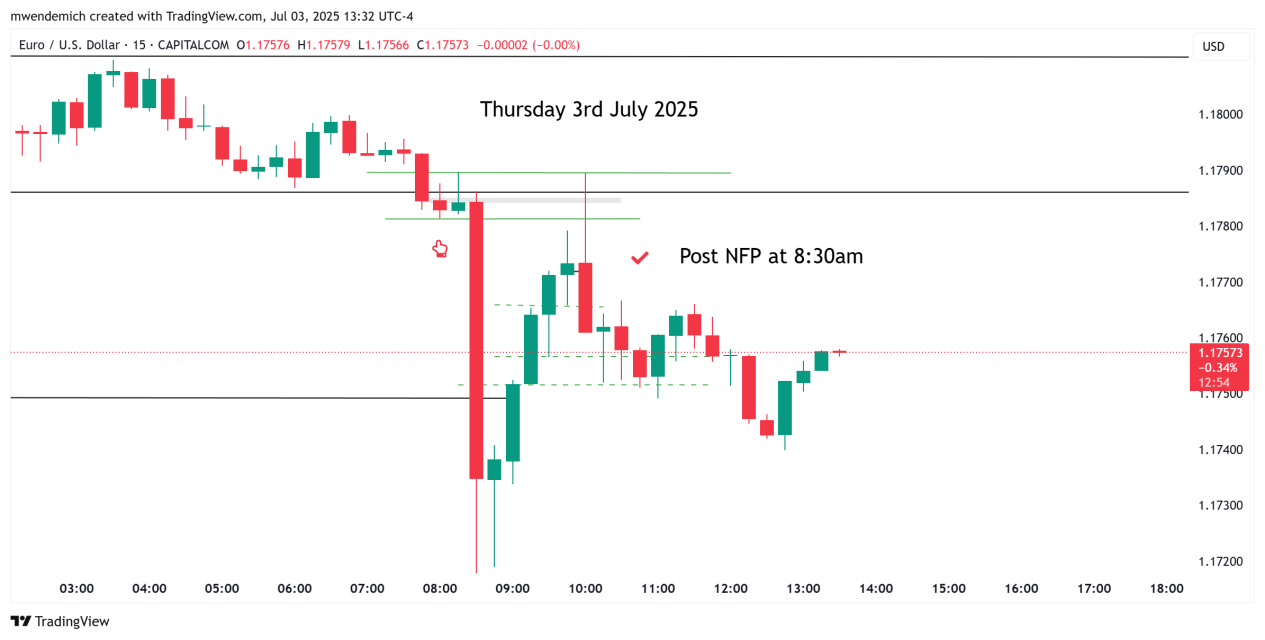

Step 1: Trade Only During New York Morning Session (8:00 AM – 12:00 Noon NY Time)

Timing is everything. This strategy works best when liquidity is highest — during the New York market open, between 8:00 AM and 12:00 Noon (New York time).

At this time, major institutions are active, spreads are tighter, and volatility is optimal for day trading setups.

Focus mainly on the EUR/USD pair, as it’s the most liquid and responds quite well to smart money movements during the New York session. Avoid trading outside this window to reduce false moves and inconsistent setups.

Step 2: Identify the 4-Hour Mitigation Block

Start your analysis on the 4-hour chart. Look for a clear mitigation block — a zone where price previously broke structure, creating an institutional reference point (like a demand or supply zone). (In the image above, the mitigation block is the green candle pointed by a hand. The red 0 sign is where I got into the trade and the dashed lines are 4hr liquidity zones, where I typically place my take profits. You can check more examples in the trades I took section)

Mitigation blocks are where price is likely to return to mitigate unfilled orders before moving in the intended direction. Your goal here is simple: mark that 4-hour mitigation block and wait patiently for price to revisit it. This higher timeframe zone gives your trade context and directional bias.

Step 3: Wait for a 15-Minute Market Structure Shift

Once price reaches the 4-hour mitigation block, zoom into the 15-minute chart. You’re looking for a true shift in market structure (MSS) — a break in the short-term trend that signals that institutional players are stepping in.

For example, in the image above, the hand sign shows the place where the price shifted lower (where a swing low was broken), the price then retraces back to that area, where I’d typically look for market entry positions, in this case this is where I would look for sell setups.

Step 3: Wait for Retracement to the 15-Minute Mitigation Block

After the structure shift, don’t rush in immediately. Wait for price to retrace back to a 15-minute mitigation block — typically the origin of the move that caused the market structure shift. In the image above, price has shifted higher and closed above the swing high pointed by a hand. The price then retraces back and I look for buy setups on the candle with an 0 sign.

This retracement is where you’ll find the best risk-to-reward entry zone, as institutions often return here to fill remaining orders before pushing price further in their direction.

Step 4: Drop Down to the 1-Minute Chart for Entry

After 4hr mitigation, 15 minute market shift, 15 minute retracement, we move to the 1-minute chart and wait for a smaller market structure shift within the 15-minute mitigation zone.

This entry technique filters out false moves and allows for tight stop-losses and high-probability entries. Your entry should align with the overall bias set from the 4-hour and 15-minute charts, ensuring perfect top-down confluence.

Step 5: Take Profit at the Nearest 4-Hour Liquidity or Fair Value Gap

Finally, your take-profit target should always be guided by the nearest 4-hour liquidity pool (such as equal highs/lows or an external range) or a 4-hour fair value gap (FVG). These are areas where the market is drawn to rebalance inefficiencies — and where institutional traders often take profits.

In the image above, take profit areas are the ones shown with a dashed line. I will do a video showing a live trading setup using this particular strategy to make it simpler to understand. In the meantime, I’d highly suggest you research more on those particular steps (4hr mitigation block, 15 minute market structure shift, 15 minute retracement and 1 minute market structure shift) as this will really improve your trading.

Why This Strategy Works

This approach combines institutional logic with precise entries:

4H provides the directional bias.

15M confirms structure shift and entry zone.

1M provides sniper-like precision.

4H liquidity/FVG gives realistic and logical take profit targets.

It’s clean, repeatable, and backed by smart money flow. No indicators. No confusion. Just price action and timing. I will link my trading journals so you can practise this strategy on the Trades I Took section.

Final Thoughts

The secret to trading success isn’t having hundreds of strategies — it’s mastering one that makes sense across multiple timeframes.

This method is arguably the only Forex trading strategy you need to know because it aligns your trade with institutional order flow from start to finish. It has also made me quite profitable if I’m being honest, and I hope it does the same for you.

Start practicing this on your demo account, you can use this link: Open your FxPesa account here. Refine your timing, and you’ll see how clarity replaces confusion in your trading journey.

This post contains affiliate links. I may earn a small commission fee if you make a purchase through the links. Thanks.

Disclaimer

The publisher and author make no representations or warranties with respect to the accuracy or completeness of these contents and disclaim all warranties such as warranties of fitness for a particular purpose. The author or publisher is not liable for any damages whatsoever. The fact that an individual or organization is referred to in this document/website as a citation source of information does not imply that the author or publisher endorses the information that the individual or organization provided. The information provided here is of the nature of a general comment only and neither purports nor intends to be, specific trading advice. It has been prepared without regard to any particular person’s investment objectives, financial situation and particular needs. The information should not be considered as an offer or enticement to buy, sell or trade.

0 comments